kern county property tax calculator

Your actual property tax burden will depend on the details and features of each individual property. Taxes on the increase in assessed property value due to ownership changes or completion of new construction are calculated as of the first day of the month following the date of.

Please type the text from the image.

. Find Information On Any Kern County Property. The Kern County assessors office can help you with many of your property tax related issues including. Property Tax Appraisals The Kern County Tax Assessor will appraise the taxable.

Property Taxes - Pay Online. While the exact property tax rate you will pay for your properties is set by the local tax. Enter a 10 or 11 digit ATN number with or without the dashes.

The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Enter an 8 or 9 digit APN number with or without the dashes. The median property tax paid by homeowners in the Bay Areas Contra Costa County.

The Kern County California sales tax is 725 the same as the California state sales tax. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. While many other states allow counties and other localities to collect a local option sales tax.

Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. Supplemental Assessments Supplemental Tax Bills. This estimator will assist taxpayers who have either recently purchased a property or those considering a purchase during the current fiscal year July 1st - June 30.

The exact property tax levied depends on the county in Montana the property is located in. Request Copy of Assessment Roll. How to Use the Property Search.

Exclusions Exemptions Property Tax Relief. Taxes - Sample Bill Calculations. Establecer un Plan de Pagos.

For comparison the median home value in California is. Ad Find Kern County Online Property Taxes Info From 2022. The median property tax also known as real estate tax in Kern County is based on a median home value of and a median effective property tax rate of 080 of.

Our Kerr County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Press enter or click to play code. Kern County collects on average 08 of a propertys assessed fair.

Property Taxes - Assistance Programs. Application for Tax Relief for Military Personnel. Business Personal Property.

Visit Treasurer-Tax Collectors site. Request For Escape Assessment Installment Plan. Application for Tax Penalty Relief.

Rent Application Form Template New Printable Sample Rental Application Template Form Rental Application Being A Landlord Rental Agreement Templates

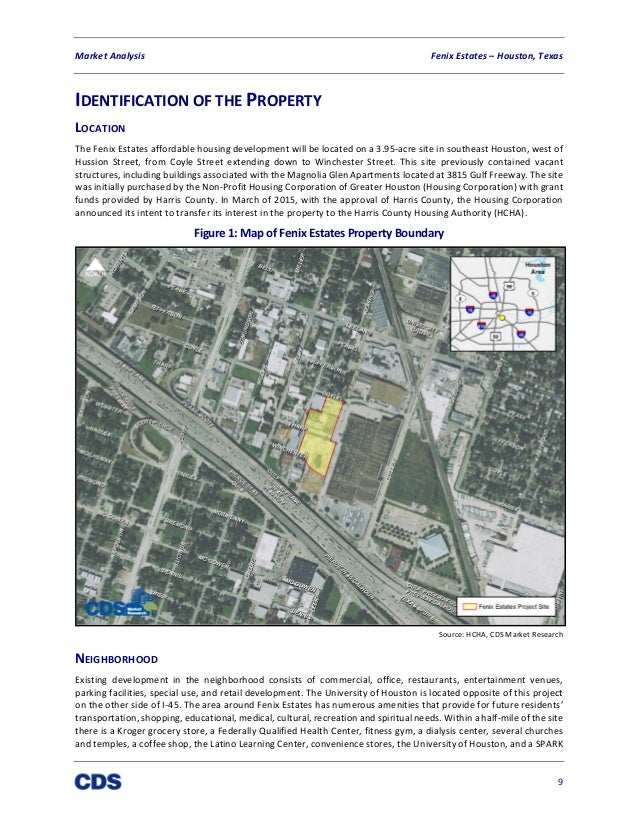

Affordable Housing Market Analysis

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

601 West 29th Street Tops Out Will Bring 200 Affordable Housing Units To Hudson Yards Manhattan New Y Affordable Housing Hudson Yards Building Development

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

California Retirement Tax Friendliness Smartasset

Niagara County New York Property Taxes 2022

Pin By Sandy Gillespie On Carolinas Estate Tax Government York County

Benjamin Watson Senior Property Tax Accountant Appeals Specialist Element Fleet Management Linkedin

California Retirement Tax Friendliness Smartasset

Pin By Sandy Gillespie On Carolinas Estate Tax Government York County

Kern County Treasurer And Tax Collector

The Nature Of Pronoia Ca 1282 Ca 1371 Chapter 8 Land And Privilege In Byzantium

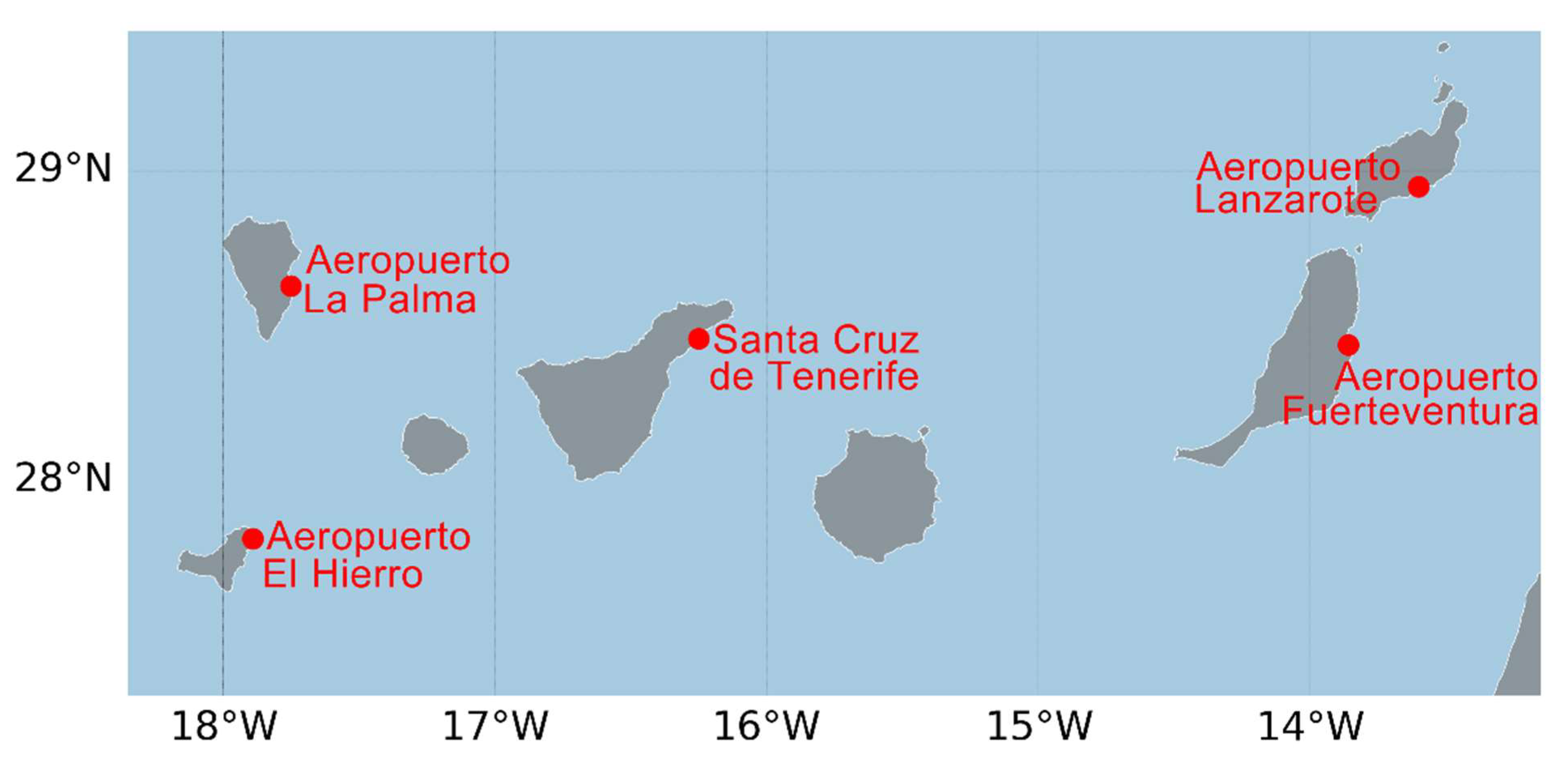

Sustainability Free Full Text Evaluation Of The Tourism Climate Index In The Canary Islands Html